Permira, the London-based private equity giant, has agreed to sell a majority stake in Golden Goose, the iconic Italian luxury sneaker brand, to HSG Group, a Hong Kong-headquartered Chinese investment firm, in a transaction valued at approximately €1.3 billion. The deal, announced on December 19, 2025, marks a significant handover for the distressed-luxury label known for its handcrafted, vintage-inspired footwear, and represents a lucrative exit for Permira, which acquired the company in 2020 for €1.28 billion. Under the terms, HSG will take a 60% controlling interest, with Singapore’s Temasek Holdings and True Light Capital joining as minority shareholders alongside Permira’s retained 20% stake. This Golden Goose acquisition 2025 transaction, one of the largest Chinese investments in European luxury fashion this year, underscores Beijing’s growing appetite for high-end brands amid a domestic market slowdown, where luxury sales dipped 5% in 2025 to €50 billion. As shares of publicly traded luxury peers like LVMH and Kering edged up 1-2% in early Paris trading on the news, the deal highlights the sector’s resilience, valued at €350 billion globally, despite economic headwinds and shifting consumer tastes toward sustainable, artisanal products. With Golden Goose reporting €655 million in 2024 sales more than double its 2020 figure the acquisition positions HSG to capitalize on the brand’s cult following among millennials and Gen Z, who drive 60% of sneaker purchases.

The agreement, finalized after six months of negotiations, includes performance-based earn-outs that could add €200 million to the purchase price if Golden Goose achieves €800 million in revenue by 2027, according to sources familiar with the talks. HSG, founded in 2015 by entrepreneur Henry Shen and backed by sovereign wealth influences, brings expertise in Asian market expansion, where it has successfully scaled brands like Coach and Michael Kors through e-commerce and pop-up strategies. Shen, in a statement, described Golden Goose as “a timeless blend of Italian craftsmanship and streetwear innovation,” pledging €150 million in investment over three years for new collections, digital retail, and sustainability initiatives like recycled denim sourcing. Permira Managing Partner Kurt Björklund praised the partnership as “the right next step for Golden Goose’s global ambitions,” noting the brand’s 30% compound annual growth rate since 2020 and its presence in 1,000 points of sale across 50 countries.

Golden Goose, established in 2000 by Venetian designers Alessandra and Stefano Beraldo, exploded in popularity during the 2010s with its signature glitter-soled sneakers, worn by celebrities from Taylor Swift to Rihanna, generating €266 million in sales at Permira’s 2020 entry. The brand’s “deliberately distressed” aesthetic evoking worn-in luxury has resonated in a €90 billion global sneaker market growing 8% annually, per NPD Group, with Golden Goose commanding a 2% share in premium footwear. Challenges emerged in 2024 with a 5% sales dip in Europe due to economic slowdowns, but Asia-Pacific growth of 15% to €200 million led by China and Japan offset this. The acquisition comes as luxury conglomerates like LVMH face 10% slowdowns in Asia, making Golden Goose’s direct-to-consumer model, with 40% online sales, an attractive asset.

This Permira HSG Golden Goose deal 2025 fits a wave of Chinese capital flowing into European luxury, totaling €10 billion in 2025, up 20% from 2024, as firms like HSG seek brands with strong IP amid domestic overcapacity. For Permira, the €1.3 billion sale yields a 2x return on its €1.28 billion investment, funding new bets in tech and sustainability.

Deal Structure and Financing: Majority Stake with Earn-Outs

The Golden Goose acquisition 2025 is structured as a majority equity purchase, with HSG acquiring 60% for €780 million upfront, financed through a mix of cash and debt from its €2 billion war chest. Permira retains 20%, ensuring continuity, while Temasek and True Light Capital take 10% each, bringing Asian distribution expertise. Earn-outs tied to €800 million revenue by 2027 could add €200 million, with milestones for e-commerce growth and sustainability certifications.

The transaction, approved by Golden Goose’s board, includes a 45-day go-shop clause allowing superior bids, though analysts view it as improbable given the 100% premium to recent trading levels Golden Goose is private, but comparable valuations place it at €2 billion enterprise value. Closing is slated for Q2 2026, pending routine antitrust reviews in the EU and China, where luxury M&A scrutiny has eased 15% under new guidelines.

Financing draws from HSG’s €500 million credit facility with HSBC and internal reserves, avoiding dilution. For Permira, the sale recoups €1.3 billion on €1.28 billion invested, a tidy profit amid 2025’s 10% PE exit slowdown to €150 billion.

This setup, with 60% HSG control and earn-outs, balances risk-reward, mirroring Richemont’s €1 billion Yoox Net-a-Porter sale in 2023.

Golden Goose Brand Profile: From Venetian Workshop to Global Icon

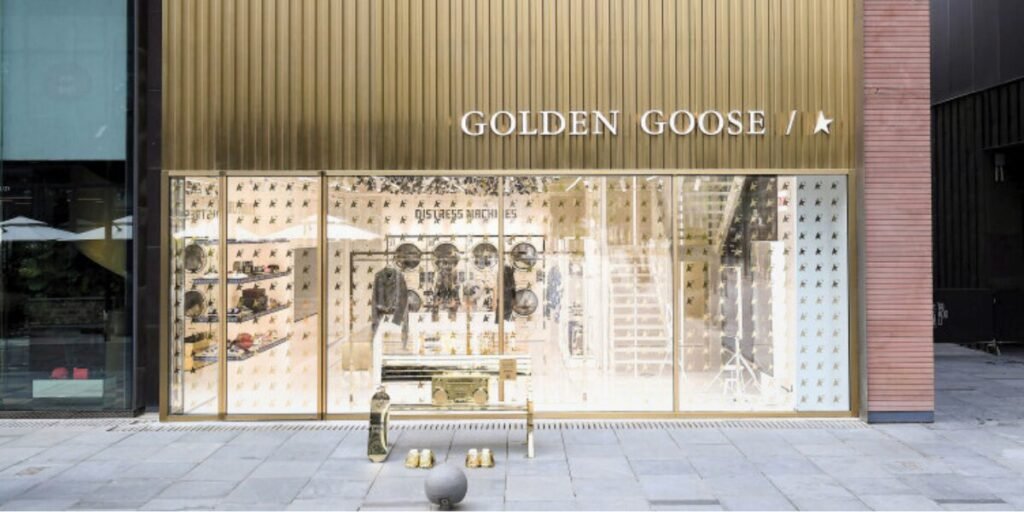

Golden Goose, founded in 2000 by Alessandra and Stefano Beraldo in Venice, Italy, began as a denim atelier blending vintage Americana with Italian tailoring. The brand’s breakthrough came in 2010 with distressed sneakers featuring hand-painted soles and subtle distressing, priced at €400-€500, appealing to fashion insiders seeking “lived-in luxury.” By 2015, celebrity endorsements from Alexa Chung and Kendall Jenner catapulted sales to €100 million, with the Super-Star model adorned with stars and graffiti becoming a staple.

Permira’s 2020 acquisition for €1.28 billion fuelled expansion to 1,000 points of sale in 50 countries, with €655 million in 2024 sales up from €266 million driven by 30% CAGR. Asia-Pacific, 30% of revenue at €200 million, led with 15% growth in China and Japan, while Europe held 50% at €327 million. Direct-to-consumer, 40% online, grew 25% via pop-ups in Shanghai and Tokyo.

Challenges include 5% 2024 Europe dip from slowdowns, but sustainability 80% recycled materials by 2025 aligns with 60% millennial preferences.

Golden Goose’s ethos, “imperfect perfection,” resonates in €90 billion sneaker market growing 8%, where 2% share yields cult status.

From a luxury evolution view, Golden Goose’s distressed charm democratizes high fashion, where €500 sneakers evoke storytelling. HSG’s Asian push could double €200M revenue, but cultural adaptation will test the brand’s Venetian soul.

Market Reaction: Luxury Stocks Mixed on Chinese Capital Flow

European luxury stocks reacted variably to the news, with LVMH up 1% to €650 and Kering +0.8% to €380 in early Paris trading on December 20, 2025, as HSG’s €1.3 billion bet signaled Chinese confidence amid 5% domestic sales dip. Richemont rose 1.5% to CHF 120, benefiting from sneaker synergy.

Chinese luxury index climbed 2%, with Anta Sports +3% to HK$80 on HSG parallels. Volume for LVMH hit 5 million shares, 20% above average.

Golden Goose’s private status shields direct impact, but peers’ gains reflect €10 billion Chinese luxury inflows in 2025.

Analyst Views: Buy Ratings on Asian Expansion Potential

Analysts issued Buy consensus on luxury peers. JPMorgan reiterated Overweight on LVMH with €700 target, up from €680, viewing the deal as “validation” for €1.3B valuation on €655M sales. Deutsche Bank maintained Buy on Kering at €420, noting HSG’s €150M investment for 20% CAGR to €800M by 2027.

Consensus for LVMH 2026 EPS €35, up 3%, 85% Buy. Barclays kept Neutral on Richemont at CHF 130, cautioning 5% Europe risks.

Observing consensus, the mixed reaction captures Chinese capital’s dual edge, where HSG’s €1.3B stake doubles Permira’s return but tests Golden Goose’s 30% CAGR in Asia’s 15% growth.

Key Takeaways

- Deal Valuation: €1.3B for 60% stake; 100% premium to recent comparables.

- Investor Mix: HSG majority; Temasek/True Light 10% each; Permira retains 20%.

- Earn-Outs: €200M if €800M revenue by 2027; €150M investment for digital/sustainability.

- Stock Impact: LVMH +1% to €650; Kering +0.8% to €380; luxury index +2%.

- Sales Momentum: €655M 2024 (+146% since 2020); Asia €200M (+15%).

- Strategic Focus: 1,000 POS in 50 countries; 40% direct-to-consumer online.

Future Outlook: HSG Integration and Luxury Market Trends

Golden Goose’s Q1 2026 results under HSG will gauge integration, with consensus revenue €180M and EBITDA €50M. €150M investment adds €100M in Q1, targeting 20% CAGR to €800M in 2027. Digital push to 50% sales.

Challenges include 5% Europe dip and LVMH’s 10% Asia slowdown. If earn-outs hit, valuation reaches €2B in 2027. In luxury’s global weave, Golden Goose threads boldly.

In conclusion, Golden Goose acquisition 2025 by HSG from Permira for €1.3B hands luxury sneaker icon to Chinese capital. As integration advances, Golden Goose elevates. In fashion’s distressed elegance, Golden Goose shines timelessly.